The report shows how strong local VC networks attract cross-border investment and highlights rising female participation among younger founders, pointing to a more diverse European VC ecosystem where skills and talent play a growing role.

Invest Europe, in collaboration with the European Investment Fund (EIF), has published a new report titled TheVC Factor: Skills Edition. The report analyses Europe’s venture capital landscape, with a focus on cross-border startup funding and the influence of education and gender on funding outcomes and startup development.

Beyond mapping current investment volumes, the Skills Edition draws conclusions with implications for investors, founders, and policymakers. The findings suggest that VC hubs which foster strong local connections are also more likely to attract investment from outside their immediate regions, potentially serving as a strategic reference point for both startups and ecosystem builders.

The analysis shows that European venture capital activity is organised around “clans” of VC hubs – interconnected but regionally defined networks that include Benelux, the British Isles, Central and Eastern Europe (including Greece), DACH, France, the Iberian Peninsula, Italy/Malta, and the Nordics/Baltics. While the data highlights growing integration across the European VC ecosystem, national and regional investment patterns remain clearly visible.

VC flows across Europe also exhibit signs of “preferential attachment”, whereby well-connected hubs tend to attract a growing share of capital over time:

- In 2021, 43% of venture capital investment crossed clan boundaries, up from 23% in 2007

- The British Isles emerged as the most connected region, acting as the preferred investment partner for five of the eight clans

- By contrast, the Iberian Peninsula and Italy/Malta recorded the highest levels of intra-regional investment, with 88% and 87% of VC capital, respectively, remaining within their regions.

Eric de Montgolfier, CEO of Invest Europe, commented:

The larger and more developed the European VC ecosystem becomes, the more we learn about how it operates.

This joint research with the EIF offers a deeper understanding of the sector’s structure and diversity – and highlights the need to unlock opportunities for talent regardless of gender or geography. A more inclusive and interconnected VC landscape will better serve entrepreneurs, investors, and society.

Education and gender: Women founders are highly qualified, but receive less funding

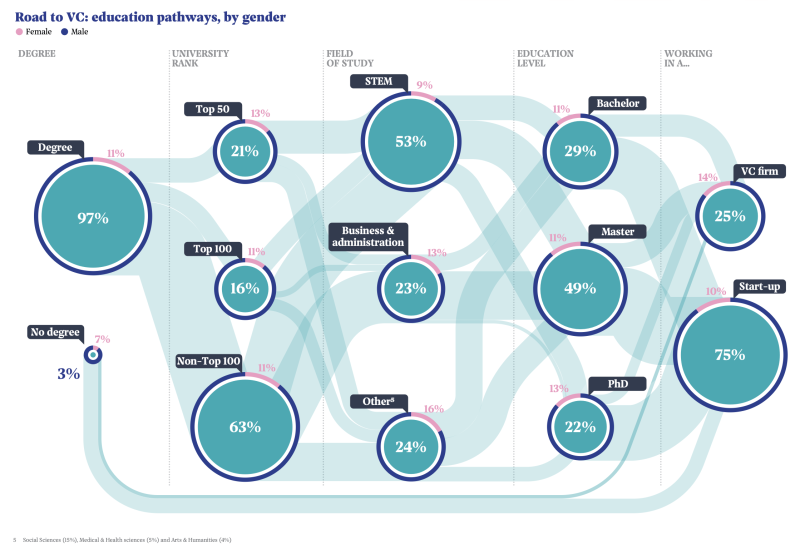

The report emphasises that the European venture capital ecosystem is shaped not only by capital flows and geographic hubs, but also by the skills, experience, and backgrounds of the individuals involved – namely, entrepreneurs and investors. Against this backdrop, it examines funding dynamics through the lenses of education and gender.

While educational background alone does not determine access to venture capital, university prestige is shown to influence funding size:

- Alumni of the top 50 universities represent 10.7% of founders but receive 15.7% of total venture capital funding, making prestige the only education-related factor that consistently correlates with larger investment volumes.

The report also notes rising female participation among younger generations of founders, indicating gradual progress towards a more diverse entrepreneurial landscape in which skills, talent, and ambition may play an increasingly important role in funding decisions.

Source: Invest Europe and EIF report “The VC Factor: Skills Edition”

At the same time, the analysis indicates that startups founded by women face structural challenges, including smaller founding teams and later access to initial funding. These factors explain only part of the observed investment gap.

Startups with predominantly female founding teams receive, on average, €700,000 less per investment than those led mainly by male founders, despite women founders tending to have higher educational attainment and greater representation among graduates of highly ranked universities.

The remaining gap appears to be associated with factors that consistently advantage predominantly male teams, pointing to persistent imbalances in how opportunity and capital are distributed across the ecosystem.