Contents

In 2025, European tech investment reached €72B across over 3,700 deals. Activity was led by key markets such as the UK, Germany, and France, with quarterly shifts highlighting varying momentum across the top ten countries.

European tech investment reached €72 billion in 2025, making it the second-strongest year of the past three, despite a modest decline from 2024. Deal activity remained stable, with over 3,740 transactions completed, broadly in line with recent years and indicating sustained investor engagement.

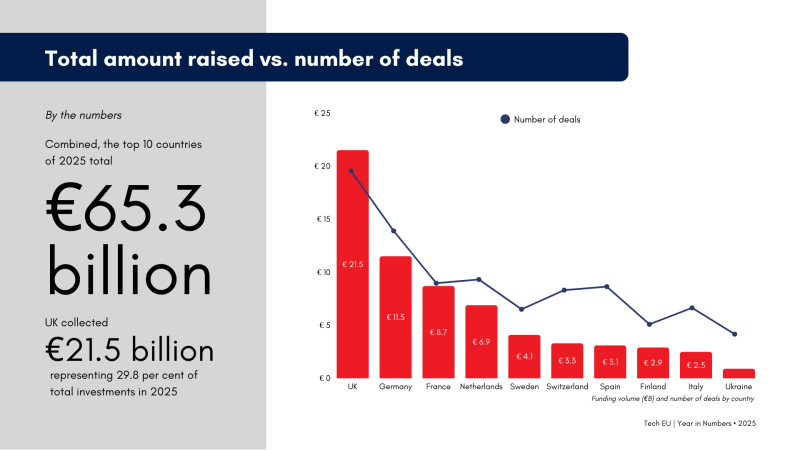

In 2025, investment became increasingly concentrated in a few major hubs, while deal activity continued to be distributed across the continent. The UK 🇬🇧 retained its position as the largest market, raising €21.5 billion across 830 deals, followed by Germany 🇩🇪 (€11.5 billion) and France 🇫🇷 (€8.7 billion), the latter boosted by several large late-stage rounds.

The Netherlands 🇳🇱, Sweden 🇸🇪, and Switzerland 🇨🇭 also held strong positions, while Finland 🇫🇮 and Italy 🇮🇹 gained momentum later in the year. Finland’s €2.9 billion came from a relatively small number of deals, suggesting a concentration of larger rounds. Ukraine 🇺🇦, with €944 million, completed the list of the top ten tech markets (largely driven by a single significant deal in the middle of the year, despite a lower volume of transactions).

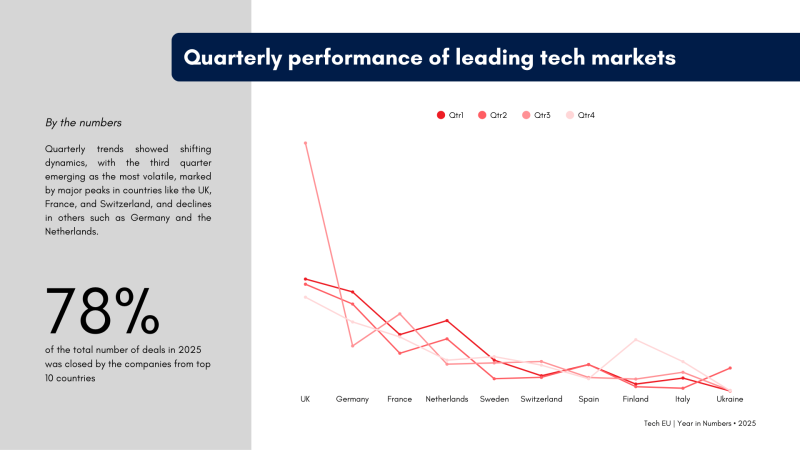

Quarterly trends revealed shifting dynamics. The third quarter stood out as the most volatile, with major peaks in countries like the UK, France, and Switzerland, and declines in others such as Germany and the Netherlands. In Q4, momentum shifted again as Finland, Italy, and Sweden recorded their strongest performances of the year. Throughout, the UK remained the consistent leader, driven by a particularly dominant third quarter.

For more detailed analyses of the European technology ecosystem, check out Tech.eu’s annual report: European Tech 2025 –The Big Picture.

Today, we’re highlighting the largest deals from each of the top 10 countries that attracted the highest investment in 2025. In the coming weeks, we’ll take a closer look at the biggest funding rounds in each country individually.

1

UK – CityFibre

Amount raised: £2.3B

As previously mentioned, CityFibre, a leading provider of full-fibre broadband infrastructure in the UK, secured £2.3 billion in financing to support the ongoing expansion of its gigabit-capable fibre-to-the-premises (FTTP) network. The funding will enable new home and business connections, as well as potential acquisitions of additional fibre network assets. This deal ranks as the largest tech investment in the UK for 2025.

2

Germany – Finn

Amount raised: €1B

Among German tech companies, FINN secured the largest investment in 2025, raising €1 billion to expand its vehicle fleet and support international growth.

FINN offers a flexible car subscription service with all-inclusive monthly plans covering insurance, maintenance, taxes, and delivery. The fully digital process allows users to order and receive a vehicle without the need for long-term ownership commitments.

3

France – Mistral AI

Amount raised: €1.7B

In France, Mistral AI secured the largest funding round of the year, raising €1.7 billion to accelerate research, expand computing infrastructure, and scale its AI platform globally.

The company builds generative AI tools that help organisations develop and deploy language models, AI assistants, and autonomous agents for tasks like search, coding, and automation. The round more than doubled Mistral AI’s valuation to approximately €11.7 billion.

4

Netherlands – NXP Semiconductors

Amount raised: €1B

In the Netherlands, NXP Semiconductors raised the largest funding round, securing €1 billion to support research, product development, and manufacturing expansion, placing it among the biggest deals in Europe last year.

The company develops semiconductor solutions (like microcontrollers, sensors, and connectivity tech) used in automotive, industrial, IoT, and mobile applications, enabling smart, connected systems.

5

Sweden – EcoDataCenter

Amount raised: €600M

In Sweden, EcoDataCenter secured the largest total funding in 2025, raising over €1.05 billion across two rounds. The largest of these, €600 million secured in September, positioned the company at the top among Swedish tech deals last year.

EcoDataCenter designs, builds, and operates high-performance data centres focused on sustainability, energy efficiency, and support for AI and cloud workloads, powered by renewable energy and innovative cooling technologies.

6

Switzerland – Energy Vault

Amount raised: €258M

Energy Vault secured the largest tech funding in Switzerland in 2025, raising a total of €325.8 million across three rounds. Its largest round, €258 million, ranked as the biggest tech deal in the country last year.

The company develops sustainable energy storage solutions using gravity- and battery-based systems to efficiently store and dispatch energy. Its technology supports grid stability and enables large-scale decarbonization, advancing the global shift to renewable energy.

7

Spain – TravelPerk

Amount raised: $200M

TravelPerk, a business travel platform that streamlines booking, management, and expense tracking for corporate travel, raised $200 million at a $2.7 billion valuation, securing the largest single tech deal in Spain in 2025.

While Multiverse Computing raised a higher total amount across two funding rounds, TravelPerk’s individual raise placed it first among Spanish tech companies by deal size last year.

8

Finland – Nokia

Amount raised: $1B

Nokia, a global provider of advanced network infrastructure and digital connectivity solutions, secured a $1 billion equity investment from Nvidia, making it the largest tech deal in Finland in 2025.

The strategic partnership aims to integrate AI into telecommunications networks and accelerate data centre development.

9

Italy – Bending Spoons

Amount raised: $710M

Bending Spoons, a company that develops, acquires, and scales consumer software products across various digital categories, secured the largest tech deal in Italy in 2025 with a $710 million round.

Although the company raised a total of approximately €1.1 billion across two financing rounds (placing it among the top companies by total capital raised), this single deal ranked first in Italy by size.

10

Ukraine – Grammarly

Amount raised: $1B

Grammarly, a Ukraine-founded company, secured a $1 billion funding round in 2025, making it one of the year’s largest tech deals. The company offers an AI-powered writing assistant used by individuals and teams to enhance grammar, tone, and overall communication.

This deal helped position Ukraine among the top 10 European tech markets by total investment in 2025, despite a relatively low volume of transactions.

1/10