Contents

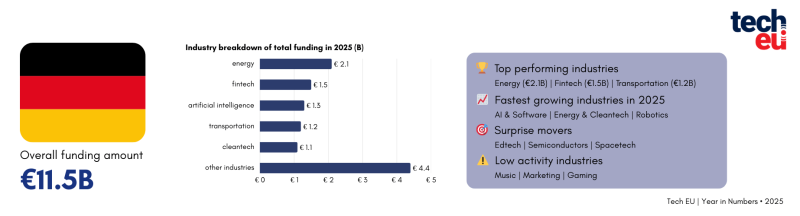

In 2025, Germany raised €11.5 billion, ranking second overall, with investment concentrated in a few core sectors rather than across high deal volume.

In 2025, European tech companies raised approximately €72 billion in total funding. Germany secured €11.5 billion across 539 deals, accounting for around 16 per cent of the total capital invested and ranking second among European countries by total amount raised.

Within Germany, the tech ecosystem was shaped less by overall deal volume and more by the size and concentration of capital flowing into a limited number of core sectors. The year was marked by several large financing rounds, particularly in energy, climate, mobility and artificial intelligence, giving the market a notably infrastructure-focused profile.

Energy attracted the highest level of investment at around €2.1 billion, followed by fintech at approximately €1.5 billion, artificial intelligence at €1.3 billion, transportation and mobility at €1.2 billion, and cleantech at €1.1 billion. This distribution highlighted Germany’s continued strength in capital-intensive, industrial and real-economy innovation.

Overall, 2025 reflected a scale-driven and high-conviction investment environment, with funding concentrated in technologies considered strategically important for long-term economic transformation and infrastructure development (for more detailed analyses of the European technology ecosystem, check out Tech.eu’s annual report: European Tech 2025–The Big Picture).

Here are the 10 companies that raised the most in 2025.

1

Finn

Amount raised in 2025: €1B

FINN is an automotive subscription platform that offers flexible, all-inclusive car subscriptions as an alternative to traditional ownership and leasing.

The service allows customers to access a range of vehicles with insurance, maintenance and other costs bundled into a single monthly fee, without long-term commitments, and delivers cars directly to users’ locations.

In 2025, FINN secured €1 billion ABS financing for fleet expansion.

2

Enpal

Amount raised in 2025: €810M

Enpal is a renewable energy company that provides solar power solutions for homeowners, including photovoltaic systems, battery storage, heat pumps and energy management services.

The company offers flexible options to rent or buy integrated clean energy systems, covering planning, installation and maintenance, with the aim of making solar energy more accessible and supporting the transition to decentralised, sustainable power.

In 2025, Enpal raised €810 million across two funding rounds to support making solar panels and heat pumps more affordable for households across Europe.

3

Helsing

Amount raised in 2025: €600M

Helsing is a defence technology company that develops AI-enabled systems and autonomous solutions to support military decision-making and security operations.

Its technology integrates artificial intelligence with existing hardware and software to produce advanced battlefield insights and autonomous systems, including AI platforms for data analysis and autonomous vehicles across air, land and sea domains.

In 2025, Helsing raised €600 million, more than doubling its valuation to €12 billion.

4

IONITY

Amount raised in 2025: €600M

IONITY is an electric vehicle (EV) charging network that builds and operates high-power charging stations along major highways and transport routes.

Founded as a joint venture by several automotive manufacturers, IONITY aims to support long-distance EV travel by providing reliable, fast charging infrastructure across Europe. Its stations offer high-capacity chargers compatible with a range of electric vehicles, helping to accelerate EV adoption and reduce barriers to sustainable mobility.

Ionity has secured €600 million in financing from nine European commercial banks in 2025, to accelerate expansion, with plans to exceed 13,000 charging points by 2030 and broaden its network across Europe.

5

Bees & Bears

Amount raised in 2025: €505M

Bees & Bears is an online marketplace that connects consumers with a wide range of natural, sustainable food and lifestyle products from independent brands.

The platform focuses on ethically sourced, eco-friendly goods and aims to make it easier for customers to discover and shop high-quality items that align with environmentally conscious values.

In 2025, Bees & Bears secured €505 million in funding, including a €500 million financing framework with a listed European bank and €5 million in seed capital. The funding will support operational scaling, expansion into commercial and industrial segments, entry into additional European markets, team growth, and the deployment of renewable energy systems such as solar, heat pumps and battery storage.

6

Green Flexibility

Amount raised in 2025: €400M

Green Flexibility is an energy company that develops, builds and operates large-scale battery storage systems to support grid stability and accelerate the integration of renewable energy.

The company focuses on strengthening energy infrastructure by providing flexible storage capacity that helps balance supply and demand within the power grid.

Green Flexibility has secured over €400 million in funding in 2025 to expand its battery storage capacity and support growing demand for grid stability and energy system flexibility.

7

Quantum Systems

Amount raised in 2025: €340M

Quantum Systems designs and manufactures unmanned aerial systems (UAS), including long-endurance drones for commercial, governmental and defence applications.

Its aircraft combine vertical take-off and landing (VTOL) capabilities with fixed-wing efficiency, enabling flexible, high-performance operations for survey, mapping, inspection and monitoring tasks across industries.

In 2025, Quantum Systems raised €340 million across two rounds (a €160 million Series C in May and a €180 million Series C extension in November) to accelerate development of its AI, software and hardware platforms, supported by its multi-domain mission software, MOSAIC UXS.

8

Tubulis Technologies

Amount raised in 2025: €308M

Tubulis is a company focused on developing next-generation antibody-drug conjugates (ADCs) and other targeted cancer therapies.

Using its proprietary biological engineering platform, the company aims to create precision therapeutics that improve treatment effectiveness while reducing side effects.

Tubulis raised €308 million in a Series C round in 2025 to advance the clinical development of its lead candidate, TUB-040.

9

Black Forest Labs

Amount raised in 2025: $300M

Black Forest Labs is a software company that builds tools to help organisations create, deploy, and monitor large-scale artificial intelligence applications.

Its platform focuses on improving AI observability and reliability, enabling teams to track performance, detect issues, and manage models throughout their lifecycle.

In 2025, Black Forest Labs closed a $300 million Series B round at a $3.25 billion post-money valuation to accelerate research and development.

10

AMBOSS

Amount raised in 2025: €240M

AMBOSS is a medical knowledge and clinical decision support platform designed for healthcare professionals and students.

It combines a comprehensive medical library with integrated clinical tools and analytics to help users study, review, and apply medical knowledge efficiently, supporting clinical decision-making and exam preparation.

In 2025, AMBOSS secured €240 million to strengthen medical knowledge and support healthcare professionals.

1/10