Contents

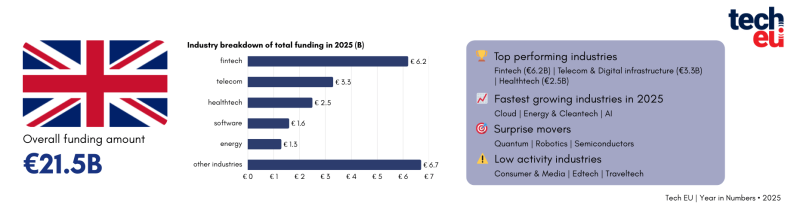

In 2025, the UK led European tech investment with €21.5 billion, combining major infrastructure-scale rounds with strong mid-sized and early-stage activity across fintech, AI, and life sciences.

In 2025, the UK led European tech investment by a wide margin, raising €21.5 billion across 830 deals and topping investment volumes in every quarter of the year.

Funding was driven by a small number of very large transactions alongside a broad base of mid-sized and early-stage activity. The largest round was CityFibre’s €2.6 billion debt financing, followed by significant raises from Propel Finance (€1.7 billion), Nscale (two rounds of €937 million and $433 million), and Isomorphic Labs (€555 million), reflecting sustained investor interest in digital infrastructure, fintech, cloud services, and life sciences.

Beyond these large transactions, investment was spread across a wide range of sectors. Fintech remained among the most active categories, while AI and data-driven companies continued to highlight the UK’s strength in applied artificial intelligence. Healthcare and biotechnology also attracted notable levels of funding.

Overall, the UK’s 2025 funding landscape combined infrastructure-scale investment with high deal activity across growth and early-stage companies, reinforcing its position as one of Europe’s most diverse and liquid technology ecosystems (for more detailed analyses of the European technology ecosystem, check out Tech.eu’s annual report: European Tech 2025 –The Big Picture).

Here are the 10 companies that raised the most in 2025.

1

CityFibre

Amount raised in 2025: £2.3B

As we already mentioned, CityFibre, a leading provider of full-fibre broadband infrastructure in the UK, secured £2.3 billion in financing to support the ongoing expansion of its gigabit-capable fibre-to-the-premises (FTTP) network.

The company will use the funding to support new residential and business connections, as well as potential acquisitions of additional fibre network assets.

2

Propel Finance

Amount raised in 2025: £1.5B

Propel Finance offers asset, vehicle, embedded, and green finance solutions that enable businesses to access essential equipment and technology through a combination of digital tools and personalised service.

The company has raised £1.5 billion to expand its lending capacity and support continued growth in SME financing.

3

Nscale

Amount raised in 2025: $1.53B

Nscale builds and operates AI infrastructure, providing GPU-powered cloud and data centre solutions for training, fine-tuning, and deploying AI workloads.

The company has raised approximately $1.53 billion across two funding rounds ($1.1 billion in late September and a further $433 million in early October) to expand data centre capacity and support global infrastructure growth.

4

Capital on Tap

Amount raised in 2025: £500M

Capital on Tap offers flexible credit solutions for small and medium-sized businesses, including business credit cards and financing products, to support cash-flow management and access to working capital.

The company secured a £500 million funding package through its third asset-backed securitisation, backed by receivables from its business credit card portfolio.

5

Isomorphic Labs

Amount raised in 2025: $600M

Isomorphic Labs applies artificial intelligence to drug discovery and life sciences research, developing platforms designed to improve the identification and design of therapeutic candidates.

Isomorphic Labs raised $600 million in its first external funding round to advance its AI drug design platform and support the progression of internal programmes toward clinical development.

6

Ferovinum

Amount raised in 2025: £400M

Ferovinum provides financing solutions for the wine and spirits industry, offering credit and funding options to support business growth and cash-flow management.

In 2025, Ferovinum secured a £400 million asset-backed securitisation facility to expand its services beyond the UK, with planned entry into the US, the EU, and Australia.

7

Verdiva Bio

Amount raised in 2025: $411M

Verdiva Bio is a company that develops next-generation therapies for obesity and cardiometabolic disorders using innovative, patient-friendly treatment approaches.

Verdiva Bio raised $411 million in a Series A round to develop next-generation oral and injectable treatments for obesity, leveraging recent advances in gut–brain biology to create new therapeutic options.

8

Believ

Amount raised in 2025: £300M

Believ is a UK-based electric vehicle charging network provider building and operating publicly accessible, renewable-energy EV charge points to support the transition to sustainable transport.

Believ secured a £300 million investment facility in 2025 to install at least 30,000 charge points, expanding access to public electric vehicle charging across the UK.

9

Carmoola

Amount raised in 2025: £300M

Carmoola is a UK-based financial technology company offering digital car finance solutions through its mobile app, enabling customers to secure and manage hire purchase and personal contract purchase loans for used vehicles.

Carmoola secured a £300 million private asset-backed securities (ABS) facility to expand its car finance offering.

10

Wagestream

Amount raised in 2025: £300M

Wagestream is a financial technology company that provides employees with access to earned wages, savings tools, and financial wellbeing services through a mobile platform.

In 2025, Wagestream secured £300 million in debt financing to expand its alternative to high-interest loans.

1/10