Contents

European tech companies raised €5 billion in January 2026. Here are the ten biggest deals of the month.

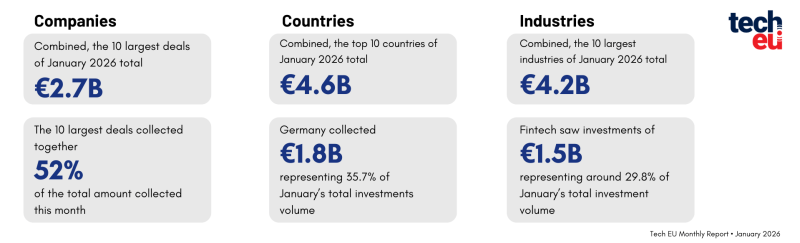

European tech startups raised €5 billion across 265 deals in January 2026, marking a 9 per cent drop in deal volume and a 24 per cent decline in funding compared with the same month year before.

Regionally, Germany stood out, with startups raising €1.8 billion, reinforcing the country’s growing share of European funding despite the broader slowdown. Sector activity remained fragmented, with fintech attracting €1.5 billion during the month.

Ion Hauer, Principal at APEX Ventures, commented on the January numbers within the European tech investment landscape in our January Tech.eu Pulse, a compact version of the monthly report:

As a deep-tech investor, I see this shift from generalist growth to specialised hardware and sovereign AI as the defining trend of this decade. We are no longer just funding software, but supporting the fundamental technologies that secure Europe’s strategic autonomy and industrial resilience.

At APEX Ventures, we predict a wave of consolidation as legacy industries acquire niche AI specialists to protect their infrastructure. In the coming years, the most successful companies will be those addressing core industrial productivity and decarbonization by using energy-efficient, scalable technologies.

For his more detailed review and more in-depth analyses of the European tech ecosystem, including industry and country performance, exit activities, and more, check out our January report.

Here are the 10 largest tech deals in Europe from January, accounting for 52 per cent of the month’s total funding.

1

Cloover (Germany)

Amount raised: $1.22B

Cloover is a Berlin-based climate technology and fintech company building a software platform to support the adoption of renewable energy.

Its platform integrates tools for financing, workflow management, procurement and energy optimisation to help installers, manufacturers, energy providers and end customers participate in the energy transition and access decentralised clean energy solutions.

By simplifying operations for installers and improving access to capital, Cloover aims to expand the use of solar, battery, heat pump and other renewable technologies across households and businesses.

Cloover has completed a $22 million Series A equity round and secured a $1.2 billion debt facility, bringing total capital commitments to $1.22 billion.

2

Parloa (Germany)

Amount raised: $350M

Parloa is a global AI technology company that develops an enterprise-grade AI agent management platform for customer service and conversational automation.

Its cloud-based platform enables organisations to design, deploy, and scale AI agents that handle customer interactions across voice and digital channels while maintaining security and compliance.

Parloa’s technology is used to automate and enhance customer service experiences by processing high volumes of natural language conversations, improving engagement and operational efficiency for large brands.

Parloa raised $350 million in a Series D funding round, vaulting its valuation threefold to $3 billion in seven months.

3

Mews (Netherlands)

Amount raised: $300M

Mews is a cloud-native hospitality technology company that provides a property management platform for hotels, hostels, and serviced accommodation providers.

The platform automates key operational tasks, such as reservations, billing, payments, and guest services, and integrates with third-party tools to support revenue management, inventory, and guest experience workflows. Mews aims to streamline hotel operations and improve efficiency for hospitality businesses around the world.

Mews raised $300 million to scale its AI-driven hospitality platform, expand fintech capabilities, and support growth across North America, Europe, and additional markets.

4

Oviva (UK)

Amount raised: €200M

Oviva is a digital health company that provides personalised, technology-enabled support for people with weight-related and metabolic conditions.

The company combines individual coaching with a digital app to help users improve eating habits, manage conditions such as obesity and type 2 diabetes, and adopt sustainable lifestyle changes. Oviva partners with healthcare systems and insurers in markets including the UK, Germany and Switzerland, using remote care tools to increase access, engagement and long-term health outcomes.

Oviva raised €200 million to bring AI obesity care to more European health systems.

5

Terralayr (Switzerland)

Amount raised: €192M

Terralayr is a technology company that provides an AI-powered data platform designed to centralise, normalise, and analyse data for businesses.

The platform enables organisations to connect disparate data sources, automate analytics workflows, and generate insights to support decision-making and performance optimisation. Terralayr’s tools are intended to help companies improve efficiency by delivering reliable, scalable data infrastructure and analysis capabilities.

Terralayr secured €192 million to further grow its grid-scale battery storage portfolio.

6

Harmattan AI (France)

Amount raised: $200M

Harmattan AI is a defence technology company developing AI-powered autonomous systems and mission software for military and security applications.

The company’s platforms include unmanned aerial systems, intelligence, surveillance and reconnaissance (ISR) tools, electronic-warfare products, and command-and-control solutions designed to operate in complex environments. Founded in 2024, Harmattan AI aims to support armed forces and allied partners with scalable autonomous capabilities that enhance operational readiness and effectiveness.

Harmattan AI completed a $200 million funding round, valuing the company at $1.4 billion.

7

Pennylane (France)

Amount raised: $200M

Pennylane is a financial operations platform that combines accounting, analytics, and workflow tools to help businesses manage their finances.

The platform integrates bookkeeping, invoicing, reporting, and real-time data insights, enabling companies and their accountants to collaborate more efficiently and make informed decisions. Pennylane aims to simplify financial processes for small and medium-sized enterprises by centralising financial data and automating routine tasks.

Pennylane raised $200 million to increase investment in R&D, including refining its product for the German market and enhancing its payments and cash management capabilities.

8

Preply (Ukraine)

Amount raised: $150M

Preply is an online learning platform that connects students with tutors for personalised language and academic instruction.

The platform allows learners to find and book lessons with qualified tutors from around the world, offering real-time sessions through integrated video and messaging tools. Preply covers a range of subjects, including language learning, professional skills, and test preparation, and uses data-driven matching to help students find tutors aligned with their goals and preferences.

The service is designed to support flexible, one-on-one learning that adapts to individual needs.

Preply secured $150 million in funding at a $1.2 billion valuation to support its next phase of growth.

9

D-Orbit (Italy)

Amount raised: €110M

D-Orbit is a space logistics and orbital services company that develops technologies for satellite deployment, in-orbit transportation, and space operations.

The company’s solutions include the ION Satellite Carrier, an orbital transfer vehicle that delivers satellites to precise orbits and supports hosted payloads. D-Orbit’s services aim to streamline satellite deployment and operations in space and support mission planning, control, and end-of-life activities as part of broader efforts to enhance space infrastructure.

D-Orbit secured €110 million to support international expansion, increase industrial capacity, and advance its technology roadmap.

10

Alvotech (Iceland)

Amount raised: €100M

Alvotech is a company focused on the development and manufacture of biosimilar medicines to improve access to more affordable biologic treatments.

The company uses a fully integrated approach, from research and development through manufacturing, to bring high-quality biosimilars to market for a range of therapeutic areas, with strategic partnerships that support global commercialisation efforts.

Alvotech secured a €100 million senior term loan facility to strengthen liquidity and support the execution of its strategic priorities in 2026.

1/10