Contents

- 1 “I only invest if I want to talk about this problem for 10 years”

- 2 The value of thematic focus

- 3 Why robotics, automation, and simulation now define the cutting edge

- 4 An activist investor for Europe’s tech sovereignty

- 5 Beyond the hype of humanoid robotics

- 6 Hacker houses, real hardware, failing fast, and next-gen founders

- 7 Backing makers of tech that “shouldn’t exist but must exist”

How tech-obsessed founders drive Andreas Klinger and PROTOTYPE's top-performing returns across three funds investing in robotics and industrial tech.

It’s not often I meet an early-stage investor who tells me that they are looking for “weird and crazy ideas.”

But Andreas Klinger, founder of PROTOTYPE, is not just any investor.

He is deeply embedded in Europe’s tech ecosystem as an early-stage investor and former founder and operator, having served as CTO at Product Hunt, VP Engineering at CoinList, Head of Remote at AngelList, and CTO at On Deck — and as a tireless advocate for Europe’s startup ecosystem through EU-Inc.

But for Klinger, investing in people with crazy ideas has paid off.

PROTOTYPE enters 2026 with strong momentum across its funds and the launch of Fund III. First-round bets power $1B+ in portfolio funding in 2025.

All of PROTOTYPE’s current vehicles rank in the global top 1–5 per cent by performance, with:

- Fund I (2019) at 4.9x MOIC (Multiple on Invested Capital) and 0.95x DPI total capital paid in,

- The Growth Fund (2022) at 5.6x MOIC and 2.75x DPI, and

- Fund II (2022) at 2.4x MOIC.

(the latter two figures representing lower-bound estimates as several rounds are currently closing).

In 2025 alone, PROTOTYPE’s first-round-focused portfolio raised well over $1 billion, with the firm backing 15 European startups, primarily in robotics, automation, and physical or frontier AI.

Against this backdrop, Fund III closed in record time and was upsized by 25 per cent due to strong demand from a predominantly European LP base of family offices, founders, and operators.

“I only invest if I want to talk about this problem for 10 years”

Fund III embodies a portfolio situated at the frontier of automation, robotics and deeptech.

So, where does Klinger place his bets?

Simply put, he’s looking for founders obsessed with their ideas, not people who spreadsheet their way into a market.”

He asserts:

“I want people who cannot stop thinking about their problem. People who work on it even if nobody is paying them yet. I also need to be genuinely excited myself. I can’t fake interest.

If I’m not intellectually and emotionally engaged, the founder will feel it immediately. I only want to work with people where I think: “I would love to spend the next ten years talking about this problem with you.”

According to Klinger, some of their most interesting investments came from people who were just obsessively building something “because it had to exist,” not because the market spreadsheet said it should.”

If you’re working on something hard, technically ambitious, and slightly insane, we’re interested.”

Prototype Capital’s portfolio comprises a broad set of early-stage technology startups pushing the frontier of automation, deep tech, developer tools, and hardware-enabled innovation.

It includes: Hyperdrives, a deeptech company developing mass-producible, high-performance electric drive systems with advanced cooling technology for industrial-scale electrification applications and the autonomous tractor market, Voltrac.

Check out our earlier interview with Hyperdrives’ CEO Robin Renz.

There’s robotics and autonomy startups like Sunrise Robotics, Rollo Robotics, Isembard, and Sensmore autonomous mining machines, and HIGHCAT reconnaissance drones.

On the software and AI side, the fund backs multimodal and AI tooling ventures like LUMA, Dust, and DX, as well as developer and infrastructure platforms such as ZED, Fly.io, and Cal.com. There’s also connectivity innovation like Willo wireless charging technology.

The value of thematic focus

Klinger attributes part of the firm’s success to being thematically focused, not just in investment strategy, but also in branding around that theme to create a synergistic effect between the portfolio companies:

“For example, Fund III is mainly robotics and automation, because that’s what we’ve been investing in over the last two years. That means, in practice, we can literally introduce companies to each other where they actually need each other. There’s real cross-pollination.”

It’s a practice he recommends to smaller VCs; however, he notes, “You need genuine competence in the theme. The focus has to be real.”

Luma AI was the standout performer in PROTOTYPE’s portfolio over the past year, marking the second company in the fund’s history to cross a billion-dollar valuation.

“They started with video AI models and are now building multimodal world models – video combined with other sensors, text, and physics. They’re basically creating systems that can ingest any kind of data. It’s a true frontier lab,” he said.

What particularly impresses Klinger is the founding team’s mindset.

“When you talk to them, you don’t get the feeling they’re trying to build ‘better software’. They say the job is to build the thing after the software. That’s a very particular kind of founder – a bit crazy in a good way. And now imagine that with a billion-dollar balance sheet.”

From a performance perspective, Klinger describes Luma as “easily the biggest success of last year” for the fund. At the same time, he notes that rapid scale can be a double-edged sword. He admits that, as an early-stage investor, he’s always a bit nervous when companies grow very big, very fast.

“I’ve worked in hyper-growth companies before. Raising huge amounts of capital can also be dangerous – it can make companies explode.”

However, he is confident that Luma’s growth has been both measured and sustainable. “They’ve grown into this scale over several years and are actually very capital-disciplined compared to other AI frontier labs. For some of those, a billion dollars is basically a seed round. So with Luma, I’m actually quite confident.”

Why robotics, automation, and simulation now define the cutting edge

The last few years have seen a shift in terms of frontier tech. Klinger asserts that in 2019, developer tooling was leading frontier tech.

“Then it was AI models. Now it’s physical AI: robotics, automation, simulation, embodied intelligence.

What excites me personally is that the frontier has moved into areas I care deeply about: robotics, hardware, and industrial systems. It makes my job much more fun.”

When it comes to robotics, Klonger cites the importance of breakthroughs in perception and reasoning.

“On the perception side, computer vision has leapfrogged. You can take an image, turn it into a video, reconstruct a 3D world from that video, simulate that world, and then train systems inside the simulation. That loop is insane. Ten years ago, this would have sounded like science fiction.

On the reasoning side, systems are no longer completely rigid. Classic industrial robotics only works if everything is in exactly the same place every time. That makes automation expensive and inflexible.”

The result is robots that can deal with variation: slightly different objects, slightly different positions, and dynamic environments. They can learn tasks, generalise, and repeat them. According to Klinger, this enables something that was previously basically impossible: small-batch manufacturing automation. He sees this as critical for Europe because most European manufacturing is not mass automotive production:

“It’s small batch and constantly changing. Until very recently, robotics didn’t work there. Now it does.”

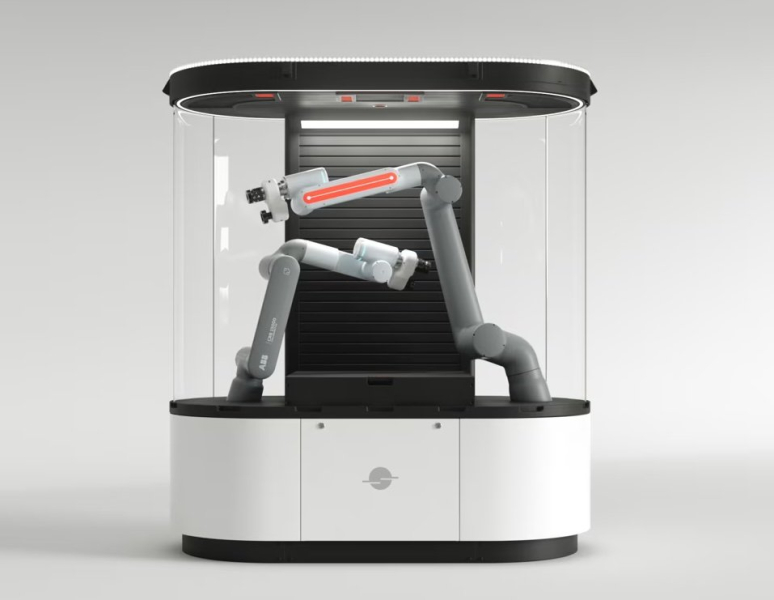

Image: Sunrise Robotics.

An example in the Prototype portfolio is Sunrise Robotics, a Ljubljana-based industrial robotics startup founded in 2023. The company builds intelligent, autonomous robotic cells that combine dual robot arms, advanced perception, and AI trained through simulation rather than hand programming. This enables rapid deployment and flexibility across diverse manufacturing environments.

Unlike traditional factory robots, which take months to install and only work in high-volume production lines. The startup emerged from stealth in 2025 with a significant seed round led by Plural, with participation from Seedcamp, Tapestry, Tiny.vc and PROTOTYPE, and has already deployed early units with partners across Europe.

An activist investor for Europe’s tech sovereignty

Klinger’s role as an investor is underpinned by a relentless commitment to scrutinise the state of European tech. I won’t mention too much about EU-Inc, as you can check out some of our earlier commentary,

He celebrates European tech, champions its startups, and lobbies politicians. He’s outspoken about Europe’s opportunity and the need for technological sovereignty. When it comes to robotics, Klinger contends that Europe has made a massive strategic mistake by selling core industrial assets and supply chains, especially in robotics, to China.

“Once supply chains move, they don’t come back. Network effects lock them in.

Robotics is one of the last areas where Europe still has deep industrial ecosystems, mainly because of automotive and machinery. If we lose that, rebuilding will be almost impossible.”

It’s a timely warning. Last year marked a major blow to European independence with ABB selling its Robotics division to SoftBank Group and Arduino acquired by Qualcomm.

That’s why Fund III is so focused on vertical robotics, automation, and their supplier ecosystems. Not just software, but motors, sensors, power electronics, manufacturing processes – the whole stack.

He warns that if those capabilities leave Europe, “then even European startups will have to build in Asia because that’s where the networks are. And once that happens, you’re done.”

Beyond the hype of humanoid robotics

When asked about the surge of interest in humanoid robotics, Klinger offers both a bear case and a bull case.

On the downside, he argues, “if I know exactly what task I want to solve, a purpose-built machine will almost always be cheaper, more reliable, and better. I don’t want a humanoid in my bathroom washing my clothes with two hands – I want a washing machine. Building an artificial human just to replicate a single appliance is insane in terms of complexity and cost.”

For most stable, clearly defined tasks, he adds, specialised machines will continue to win. The upside, however, lies in flexibility and scale. The first element is what Klinger calls the “last-step problem.”

“In many industrial processes, you can automate 90 per cent per cent with specialised machines, but the final 10 per cent still requires flexibility, dexterity, or problem-solving in an unstructured environment. Suddenly, you need a human anyway.

At that point, instead of buying three different robots and still needing a person, it might make sense to have one generalist system that can do the whole chain.”

The second argument is an analogy with consumer technology. “A digital camera is better than the camera in my phone. A walkie-talkie is better at communication. A GPS device is better at navigation. But I already have an iPhone. It’s good enough at all of them, and it benefits from massive economies of scale. So you build apps on top of it.”

Hacker houses, real hardware, failing fast, and next-gen founders

Klinger sees hacker culture as critical to building a frontier-tech pipeline in Europe. He asserts that Europe needs more self-selecting spaces for “highly technical, slightly crazy people: hacker houses, robotics clubs, student labs, informal research groups.”

“These places produce more outliers than most heavily funded government programmes, because they are driven by intrinsic motivation, not grants.

People work nights and weekends because they love it, not because it’s in a project plan.I’ve seen this in Austria, in Armenia, in parts of Germany.

When you put young people into environments where they can build real hardware, real software, real systems – and you let them fail and try again – you get extraordinary results.”

Backing makers of tech that “shouldn’t exist but must exist”

In terms of outreach, PROTOTYPE, like most investors, prefers warm introductions, but his public presence means it’s easier to get on his radar compared to some other investors.

Klinger stressed:

“Talk to us even if you’re not sure your idea is a company yet. Especially in robotics, automation, energy, space, and physical AI – many of the best companies start as “this probably shouldn’t exist, but it has to exist.”

PROTOTYPE wants to change the innovation narrative. Klinger asserts that while Europe has talent, science, and the requisite industrial base, it often lacks the confidence and coherent storytelling around frontier technology.

“World-class robotics, automation, hardware, and physical AI can be built here – and that they don’t have to move to the US or China to become global leaders.

Fund III focuses on reindustrialisation, robotics, automation, and sovereignty-relevant technologies. But beyond capital, it’s also about changing how people perceive what’s possible in Europe.

There is a generation of founders here who are deeply technical, deeply obsessed, and building extraordinary things. Our job is to back them early, provide the network they need, and ensure they can scale without leaving the continent.”