Contents

France remained one of Europe’s leading tech markets in 2025, ranking third by funding, supported by several large late-stage rounds in AI, energy, and deeptech.

In 2025, European tech investment totalled €72 billion, marking the second-strongest year of the past three and demonstrating continued market resilience despite a modest 3.2% decline from the 2024 peak.

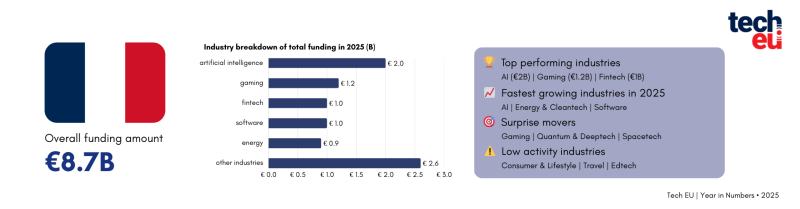

Within this landscape, France remained one of Europe’s key tech markets, ranking third with €8.7 billion raised (behind the UK with €21.5 billion and Germany with €11.5 billion), supported by several large late-stage rounds in AI, energy, and deep tech.

France’s tech funding landscape was heavily influenced by artificial intelligence, which attracted the largest share of capital. While one very large round significantly lifted the total, a series of mid-sized AI investments also pointed to sustained investor interest across different maturity stages.

Fintech remained a major funding recipient, supported in part by debt and later-stage deals, while software attracted significant capital spread across multiple transactions. Gaming activity was largely driven by one major deal alongside smaller rounds, and energy continued to benefit from investment in charging and hydrogen, with cleantech and security showing steady but more moderate momentum.

Overall, capital deployment remained highly concentrated, with a small number of very large rounds shaping the aggregate totals, complemented by a broader base of mid-sized financings across multiple industries. (for more detailed analyses of the European technology ecosystem, check out Tech.eu’s annual report: European Tech 2025–The Big Picture).

Here are the 10 companies that raised the most in 2025.

1

Mistral AI

Amount raised in 2025: €1.7B

Mistral AI develops generative AI models and tools that enable organisations to build, customise, and deploy large language models, AI assistants, and autonomous agents for applications such as search, coding, automation, and data processing.

The company raised €1.7 billion in 2025, which more than doubled its valuation to about €11.7 billion, with ASML taking a major stake as part of a strategic partnership.

2

Ubisoft

Amount raised in 2025: $1.25B

Ubisoft develops and publishes interactive video games and entertainment for console, PC, and online platforms, with franchises including Assassin’s Creed, Far Cry, Tom Clancy’s, Just Dance, and Watch Dogs. The company focuses on delivering immersive gaming experiences and expanding its digital entertainment ecosystem globally.

In 2025, the company raised $1.25 billion to support its core game development operations and long-term content production.

3

Brevo

Amount raised in 2025: €500M

Brevo is a cloud software company that provides an all-in-one customer engagement platform combining email and SMS marketing, marketing automation, CRM, live chat, and transactional messaging in a single interface.

The company focuses on helping businesses, particularly SMEs, centralise customer communications and manage the full customer lifecycle through multichannel campaigns, data tools, and AI-powered features.

In 2025, Brevo became a unicorn after raising €500 million in a funding round led by General Atlantic and Oakley Capital.

4

Electra

Amount raised in 2025: €433M

Electra is an electric mobility company that designs, installs, and operates ultra-fast charging stations for electric vehicles, combining proprietary software, site development, and network management to support large-scale EV adoption across Europe.

In 2025, Electra secured a green loan facility of up to €433 million, bringing its total funding since inception to over €1 billion.

5

Younited

Amount raised in 2025: €400M

Younited is a credit institution that provides fully digital consumer lending and payment solutions to individuals, merchants, banks, and fintech partners.

Through its proprietary technology platform, the company enables instant credit decisions, transparent pricing, and seamless financing embedded into customer journeys. Operating across multiple European markets, Younited focuses on modernising consumer credit with data-driven underwriting and a fully online experience.

Younited secures €400 million warehouse facility from Citi in 2025, to expand European consumer credit.

6

HoloSolis

Amount raised in 2025: €220M

HoloSolis is a renewable energy company developing one of Europe’s largest photovoltaic manufacturing facilities to produce high-efficiency solar cells and modules locally.

The company aims to strengthen Europe’s energy sovereignty by building a large-scale, low-carbon solar supply chain and supporting the continent’s transition to renewable power.

In 2025, HoloSolis secured €220 million to build one of Europe’s biggest solar factories.

7

Lhyfe

Amount raised in 2025: €149M

Lhyfe is a renewable energy company that produces and supplies green hydrogen for mobility and industrial uses.

The company designs, installs, and operates production sites powered by renewable electricity, enabling customers to decarbonise operations and transition away from fossil fuels.

In 2025, Lhyfe secured a €149 million grant from the French government for its future green hydrogen production plant located near the Grand Canal of Le Havre.

8

Alice & Bob

Amount raised in 2025: €100M

Alice & Bob is a quantum computing company developing hardware and software to build universal, fault-tolerant quantum computers using its proprietary cat-qubit architecture.

The company focuses on reducing quantum error rates through built-in error correction to enable scalable, practical quantum systems.

In 2025, Alice & Bob raised €100 million to accelerate development of its fault-tolerant quantum computing technology and advance its roadmap toward building a useful quantum computer by 2030.

9

WAAT

Amount raised in 2025: €100M

WAAT is an electric mobility company that designs, installs, and operates turnkey charging infrastructure for electric vehicles, primarily serving residential buildings, workplaces, and private parking environments.

The company provides end-to-end services, from technical studies and installation to supervision and billing, to accelerate EV adoption across France.

WAAT raised €100 million in 2025 to accelerate its expansion in France and across Europe.

10

Flowdesk

Amount raised in 2025: $102M

Flowdesk is a crypto-financial services company that provides market making, OTC trading, and digital asset infrastructure for Web3 and institutional clients.

The company combines proprietary algorithmic trading technology with global exchange connectivity to deliver liquidity, brokerage, and treasury solutions across the digital asset ecosystem.

In 2025, Flowdesk raised $102 million to support global expansion and meet growing demand for liquidity provision and OTC trading solutions.

1/10